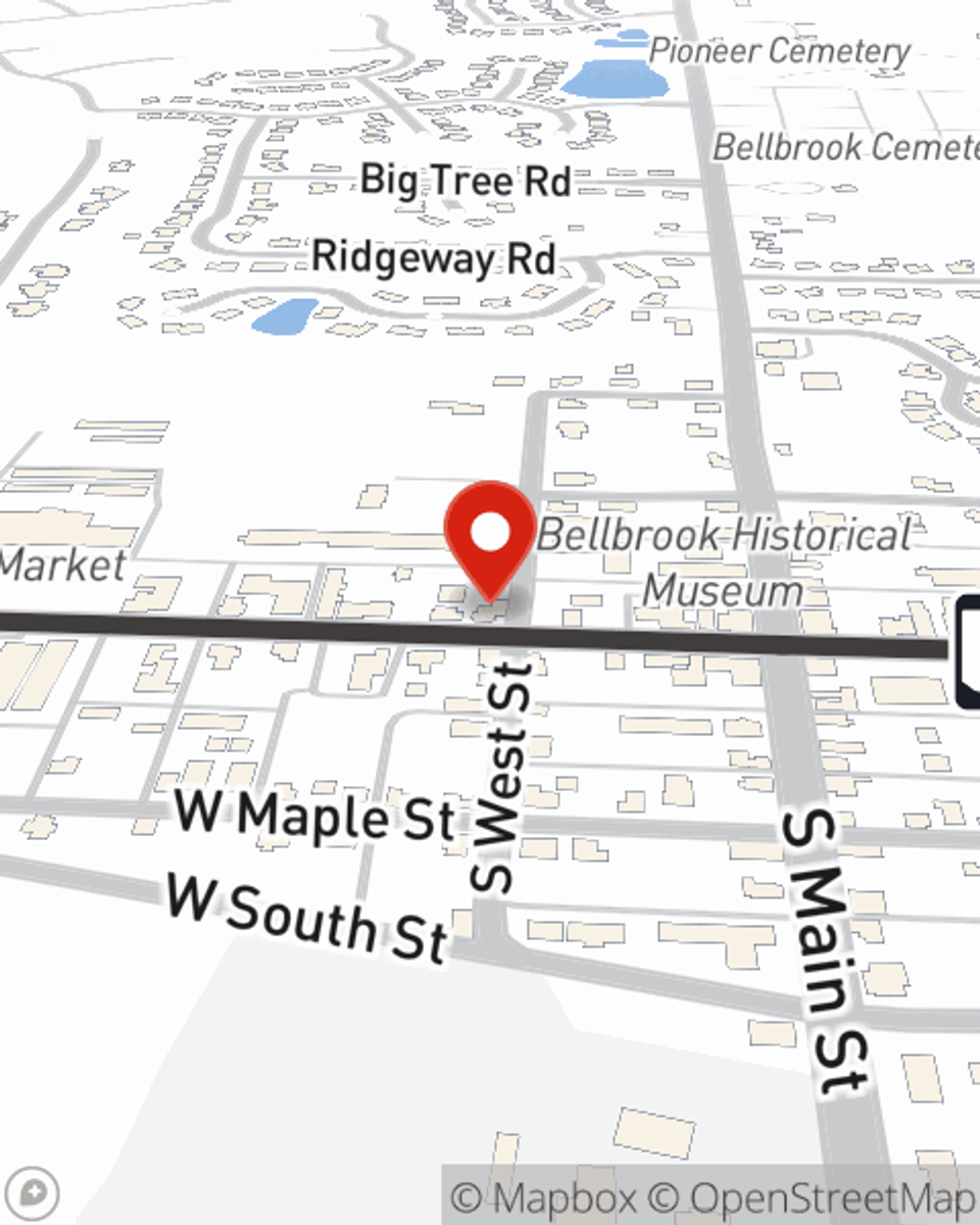

Condo Insurance in and around Bellbrook

Get your Bellbrook condo insured right here!

Insure your condo with State Farm today

Welcome Home, Condo Owners

Often, your home base is where you are most able to unwind and enjoy your favorite people. That's one reason why your condo means so much to you.

Get your Bellbrook condo insured right here!

Insure your condo with State Farm today

Why Condo Owners In Bellbrook Choose State Farm

We know how you feel. That's why State Farm offers outstanding Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Katie Martin is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that provides what you need.

Insuring your condo with State Farm can be the right thing to do for your home, your loved ones, and your belongings. Get in touch with Katie Martin's office today to learn more about how you can meet your needs with Condo Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Katie at (937) 848-6000 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Katie Martin

State Farm® Insurance AgentSimple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.